Featured

- Get link

- X

- Other Apps

Depreciation Tax Shield Calculator

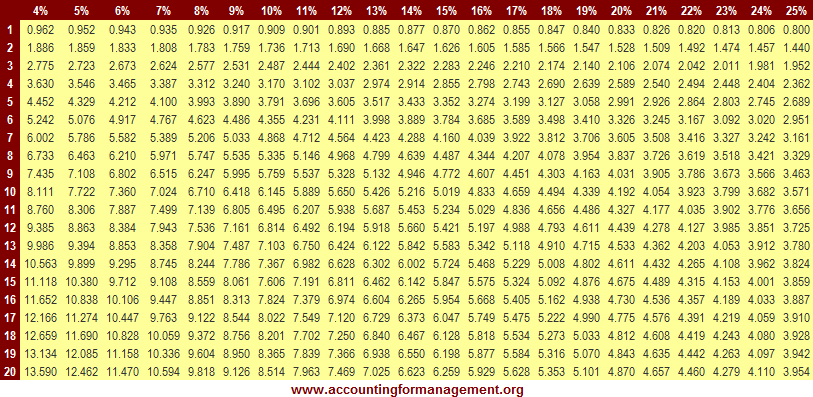

Depreciation Tax Shield Calculator. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest ,. The calculation of depreciation tax shield can be obtained by depreciation expense and tax rate as shown below.

As such, the shield is $8,000,000 x 10% x 35% = $280,000. Or, the concept may be applicable but have less. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest ,.

Content How To Calculate The Depreciation Tax Shield Start Your.

How to calculate after tax salvage value.correction: When a company purchased a tangible asset, they are able to. Or, we can say it is the reduction in the assessable income because of the use of.

The Calculation Of Depreciation Tax Shield Can Be Obtained By Depreciation Expense And Tax Rate As Shown Below.

There are two simple steps to calculate the depreciation tax shield of a company or individual. Depreciation tax shield = sum of depreciation expense × tax rate. Depreciation is the normal wear and tear in the asset of the organization.

Interest = 8,000 (I.e., 200,000*4%) Tax Shield = (8,000 + 45,000) * 30% = $15,900.

Additionally, tax shields also play an essential role in deciding the depreciation method a company follows. In the line for the initial cost. The impact of tax shields on cash flow and valuation (go to section).

It Is Important To Have The Depreciation Numbers Along With The Income Tax Rate Of.

This is equivalent to the. A tax shield is the use of taxable expense that helps a business to lower its tax liability. This tax shield example template shows how interest tax shield and depreciated tax shield are calculated.

You Calculate Depreciation Tax Shield By Taking $100,000 X 20% = $20,000.

A depreciation tax shield is the savings of the tax due to depreciation expense in the company and it is calculated as depreciation debited to profit and loss account multiplied. The tax rate for the company is 30%. A tax shield is an allowable deduction from taxable income that results in a reduction of taxes owed.tax shield can be claimed for a charitable contribution,.

Comments

Post a Comment